ASIC has provided some information for listed and unlisted public companies with a financial period ending 31st December and are required to hold an AGM by 31st May.

No-action on AGM’s due by 31st May

Due to gathering restrictions, ASIC will not take action against an enti...

NFP's preparing for audit in the face of Covid-19

March 30, 2020

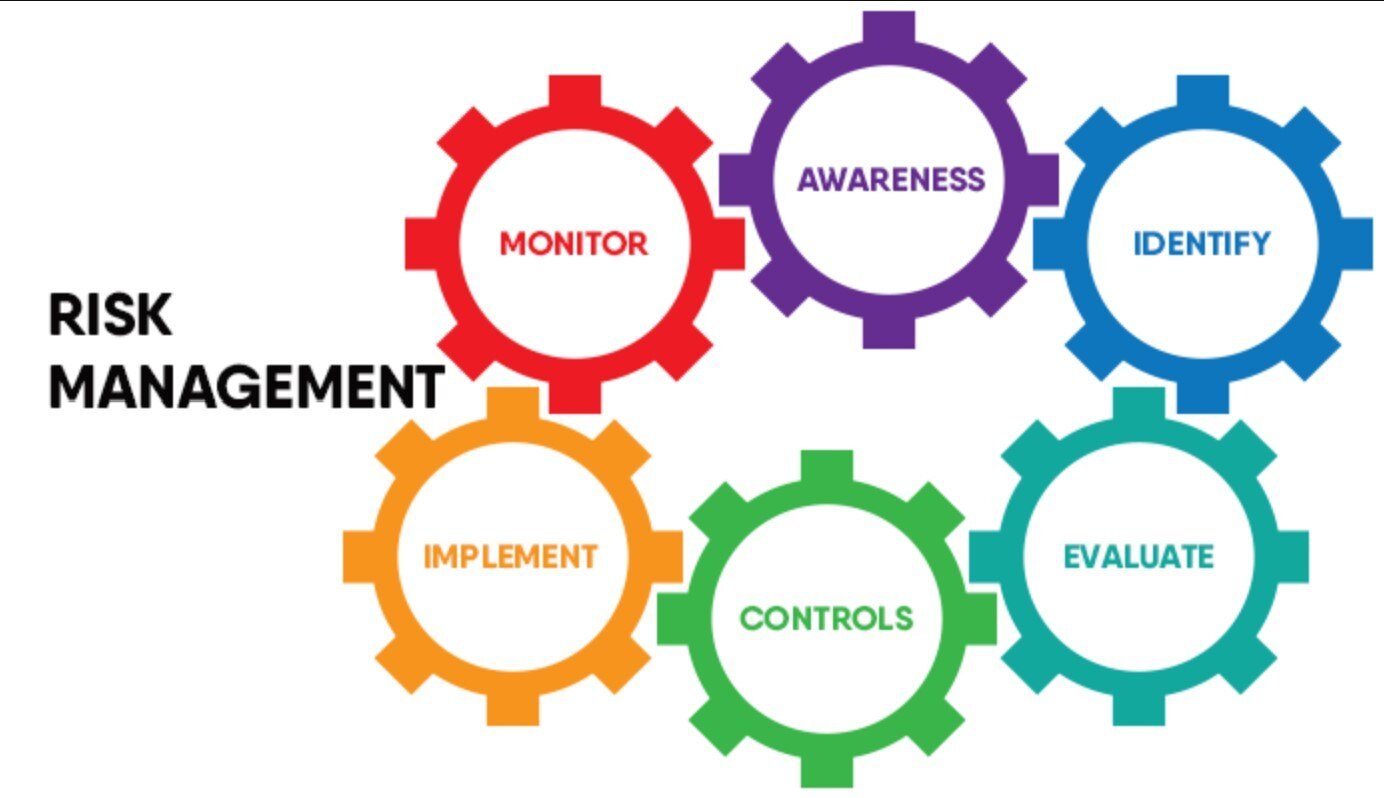

The impact of Covid-19 is being felt across Australia’s economy and the rest of the world. It’s creating greater uncertainty both now and into the future, creating more risks that may not have been encountered before.

Management and Board need to perform appropriate risk...

Revised Commonwealth Government Support

March 22, 2020

Wow- what a weekend it has been!!Revised cashflow suport for business & Not for Profit in summary:Paying PAYG quarterly- the whole PAYG amount will be provided in a grant for the March & June payments.Additionally if you add those 2 payments together & divide by 4 you will r...

State Government Payroll Tax Relief Measures

March 22, 2020

ACT

All ACT businesses with Australia-wide wages of up to $10 million can defer their 2020-21 payroll tax, interest free until 1 July 2022.

How to apply

Businesses will need to complete a simple online application form (which will be available soon) to confirm their ...

These measures are available now!!

Allowing businesses to vary their PAYG Instalment (Company tax) to Nil in the March quarter BAS

This is huge!! Varying the PAYG Instalment to Nil in the March BAS will automatically trigger a refund of the September & December instalments p...

Business Continuity

March 16, 2020

We wish to outline the measures being taken by Successful Alliances to ensure business continuity and security of your data during the Covid-19 outbreak.

Successful Alliances has worked with our IT company to ensure all staff have secure access to our servers and online file...

Key Changes to Modern Award Annualised Salaries

February 21, 2020

From the 1st of March 2020 changes have been made to annualised salaries covered by some modern awards. Employers must comply with these changes, including a new notification, annual reconciliation and record-keeping.

Employers in the past have reached an agreement with thei...

We are excited to announce that with the beginning of the New Financial Year Successful Alliances is launching a secure portal for the transfer of data between our team & clients.

Once invited, clients can receive documents from Successful Alliances as well as upload documen...

Single Touch Payroll

May 28, 2018

Single Touch Payroll (STP) is the most significant change in reporting to the Australian Taxation Office (ATO) for businesses since the introduction of the GST in 2000.

STP will commence for substantial employers and those who elect to opt in from 1 July 2018 and the plan is...

18 years of bookkeeping

May 12, 2018

Successful Alliances’ agility in bookkeeping – 18 years and counting

https://www.myob.com/au/blog/s......